About Our FinTech Project

At FinTech, we're transforming finance with cutting-edge technology. Our FinTech project empowers investors with automated, AI-driven asset management solutions, offering real-time insights, reducing risk, and enhancing value through smarter, data-driven investment strategies.

Overview

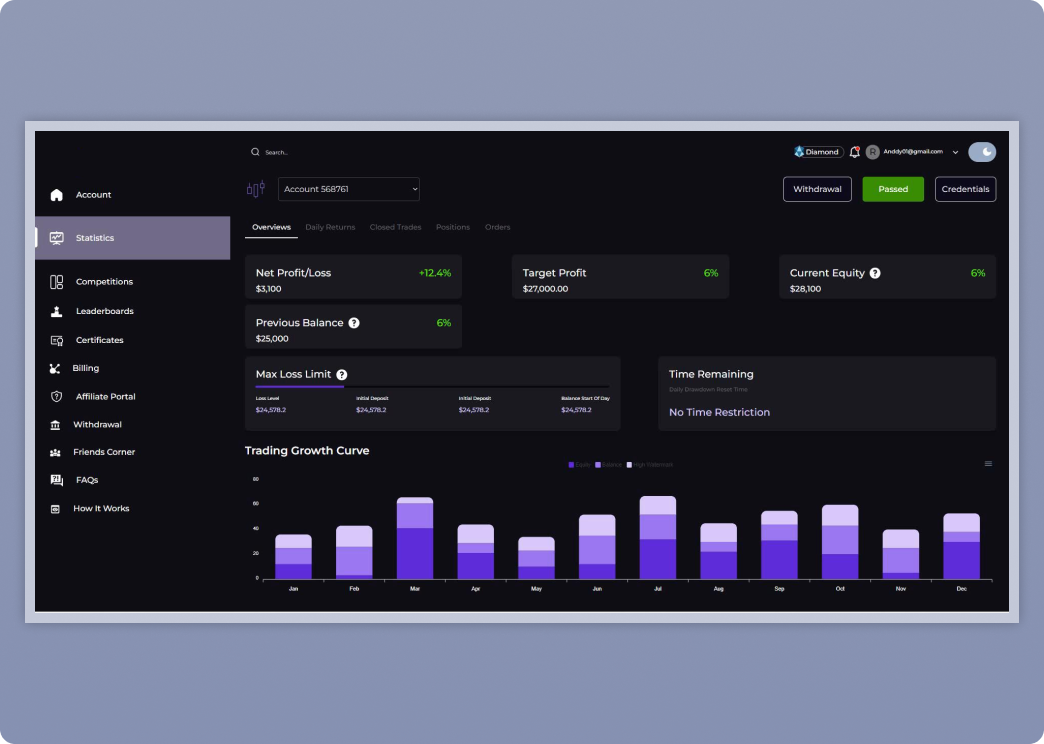

The CollectiveFund App is a cutting-edge syndicate funding platform designed to simplify fund management, enhance user engagement, and foster a collaborative investment community. With features like competitions, leaderboards, and the social “Friends Corner,” it combines robust financial tools with community-building elements. The platform further ensures seamless operations through features like billing management, an affiliate program, and an extensive FAQ section, offering users an optimized and rewarding experience.

Challenges

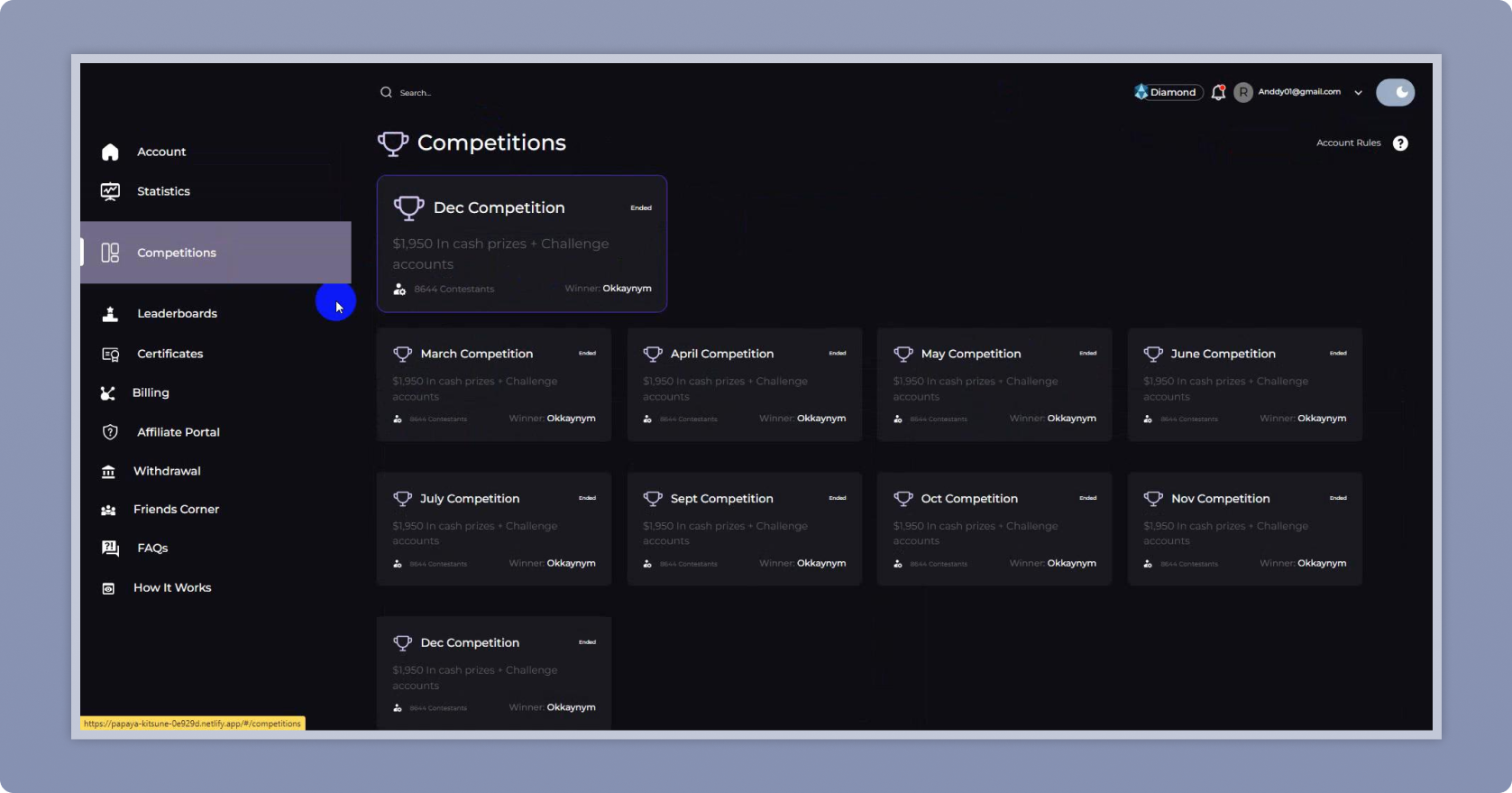

User Engagement: Keeping users engaged through interactive features like competitions and social elements while maintaining a professional financial environment.

Compliance and Transparency: Ensuring adherence to financial regulations and providing users with clear and detailed records of their transactions and fund performance.

Scalability: Managing a growing user base with real-time data and analytics, especially during high-volume activities like competitions.

Affiliate Program Integration: Building a seamless affiliate portal that incentivizes user referrals while ensuring transparency in commission tracking.

Solutions

1. Interactive Features for Engagement:

Developed an engaging “Friends Corner” and leaderboards to encourage a sense of community and friendly competition among users.

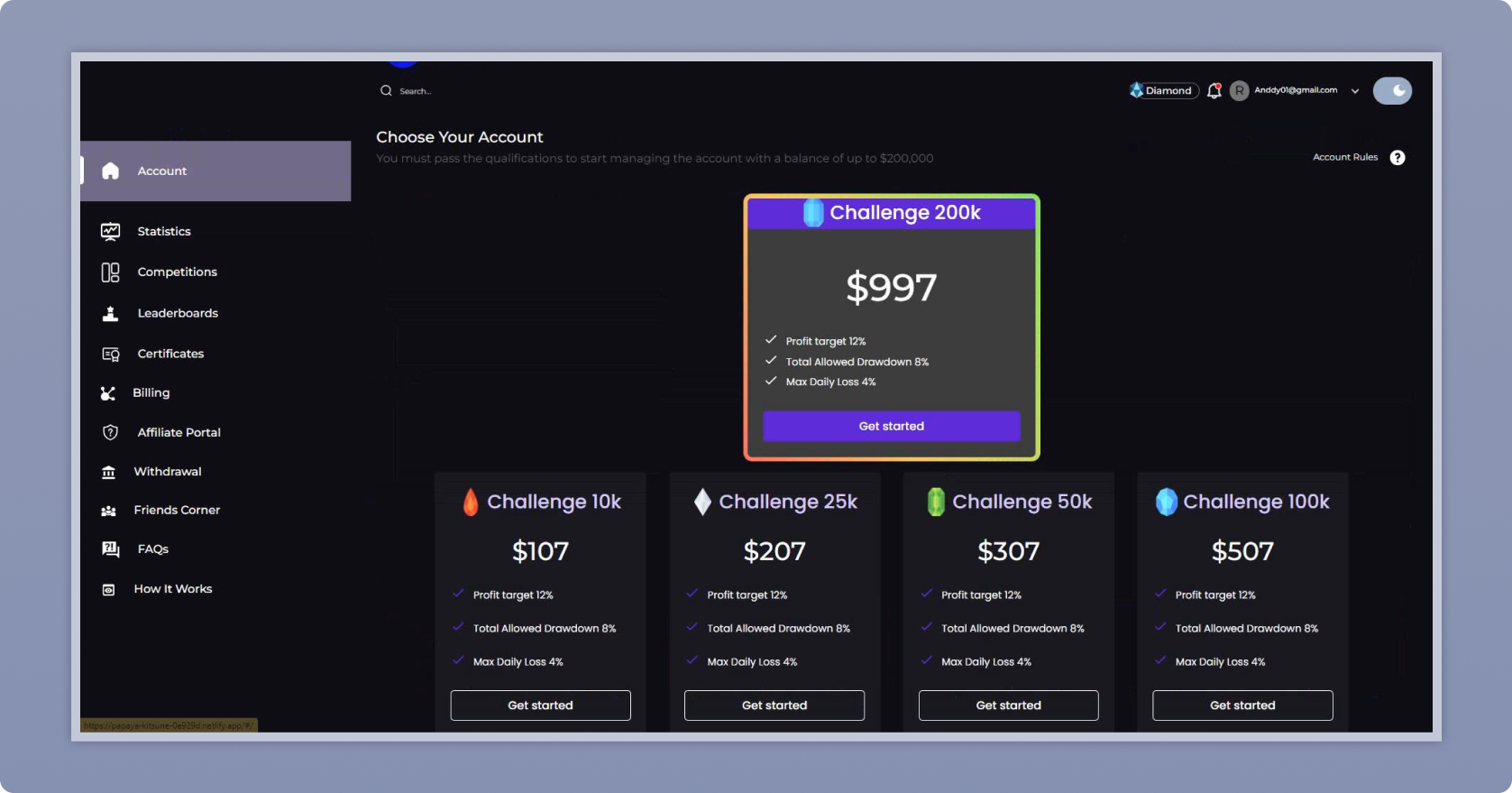

Hosted investment challenges simulating real-world scenarios to help users refine their strategies.

2. Comprehensive Fund Management Toolst:

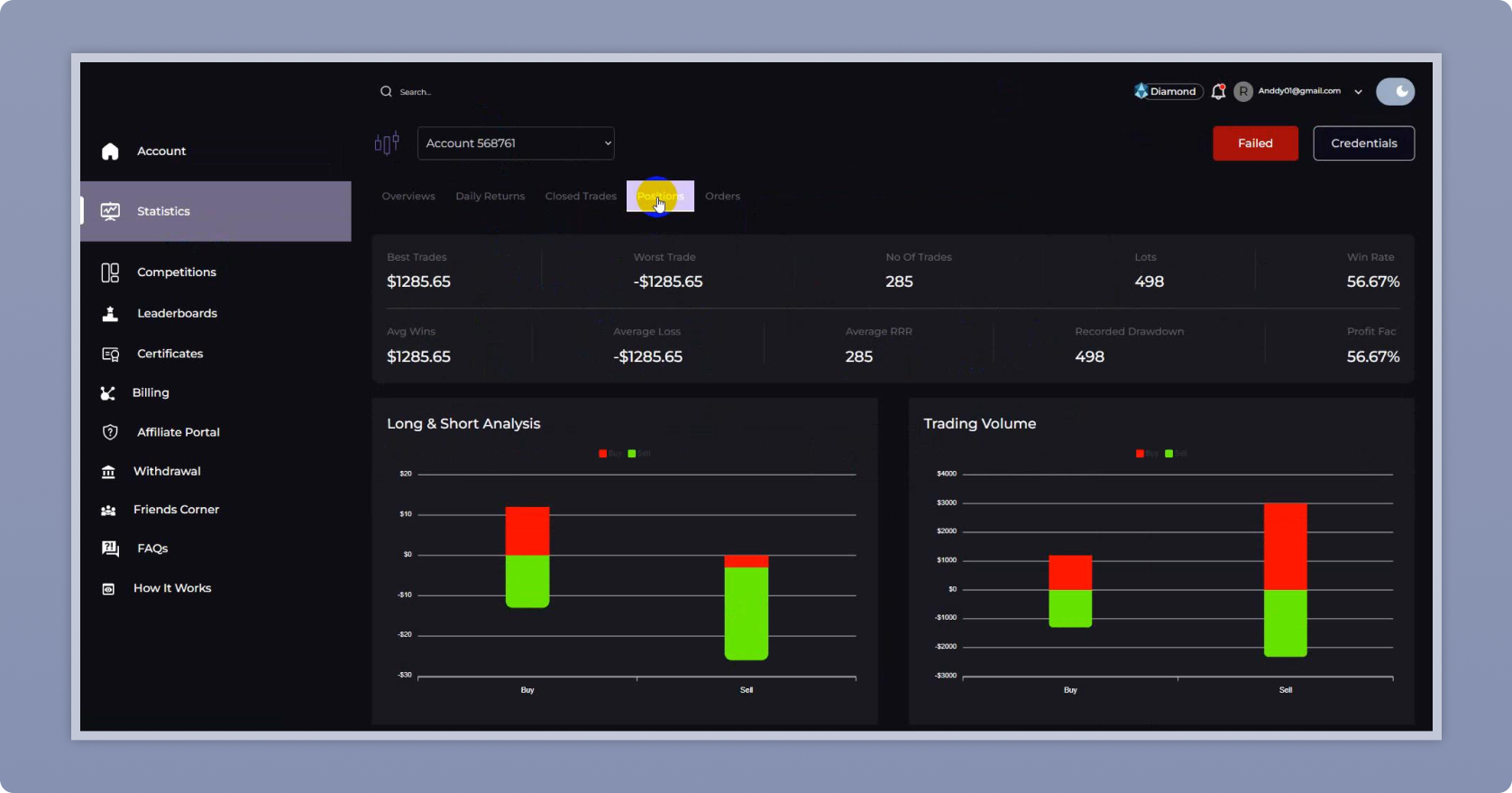

Introduced detailed statistics dashboards offering real-time and historical insights into metrics such as Net Profit/Loss, Current Equity, Target Profit, Daily Returns, and Closed Trades.

Ensured transparency with a billing management system detailing all transactions, contributions, fees, and distributions.

3. Scalable Architecture:

Designed the platform to handle real-time data processing and analytics for a growing user base, ensuring seamless operations during peak activities.

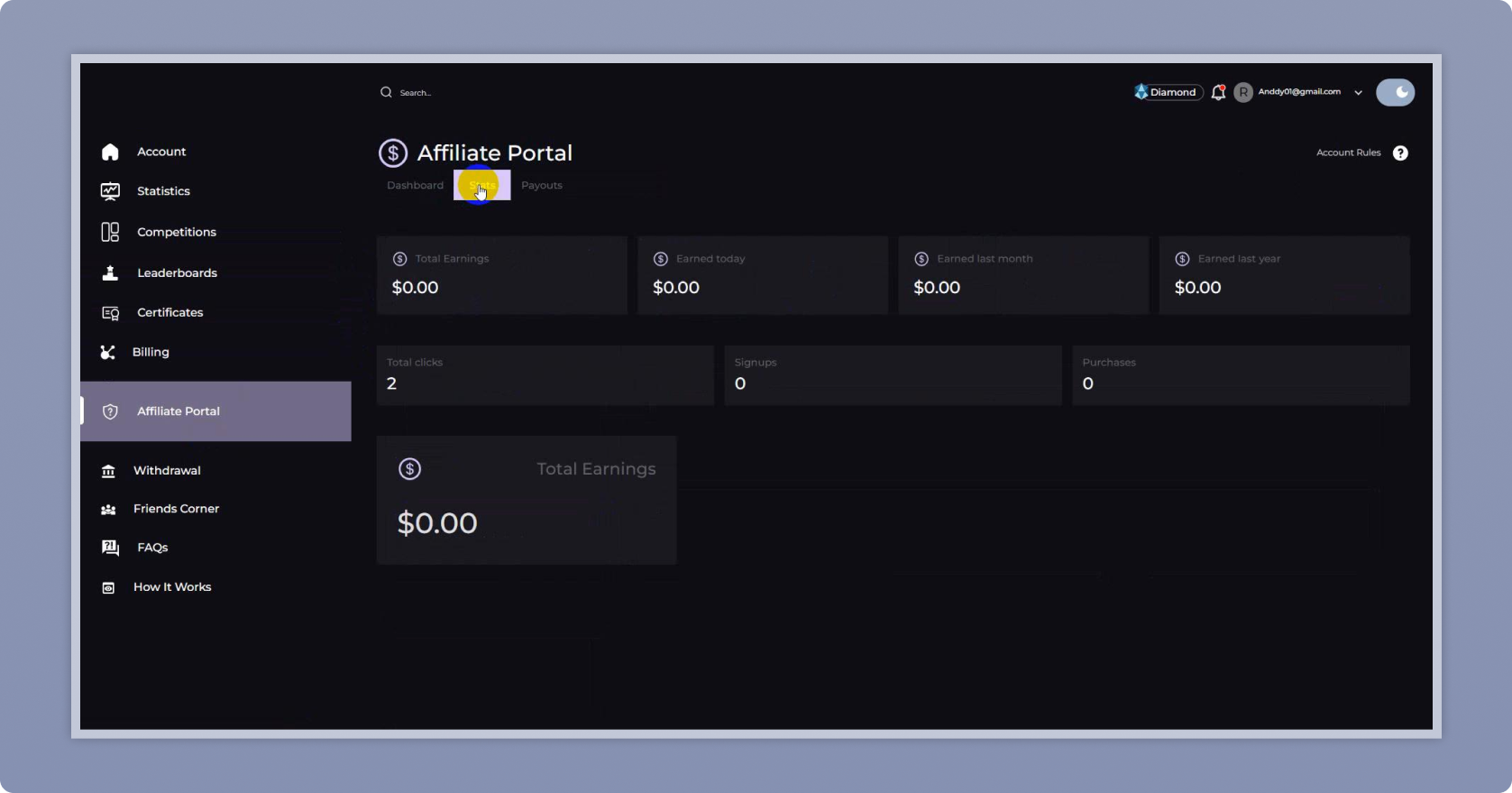

4. Affiliate and Billing Portals:

Built an Affiliate Portal enabling users to earn commissions through referrals, with clear tracking and reporting.

Integrated a robust billing system to manage subscriptions and financial transactions efficiently.

Results

Enhanced User Engagement: The introduction of competitions and social features significantly boosted user interaction and retention.

Transparency and Trust: Real-time statistics and detailed billing records have increased user trust in the platform’s transparency and compliance.

Increased User Base: The affiliate portal and community-driven approach have attracted new users, contributing to rapid platform growth.

Streamlined Operations: The comprehensive toolset has optimized fund management processes, saving users time and effort while improving decision-making.

Technology Stack

-

Frontend

-

Backend

-

Database

-

Hosting